According to research commissioned by Bacs Payment Schemes Ltd earlier this summer, more than a third of SMEs across the UK are affected by late payments. The findings tally with earlier studies by the Federation of Small Businesses, which fears as many as 50,000 small businesses a year are going bust because of payment delays.

It’s a perennial issue for small firms and if left un-tackled can result in insolvency. It’s one of the biggest problems facing company owners.

But there are ways to reduce the problem. Our Managing Director Raymond Liu offers five tips to businesses to help get on top of late payments.

- Communicate with your clients. Don’t be shy about talking money. Make an effort to understand any cultural differences between your business and your client. Get to know their accounts people and develop good relationships in order to understand their processes. Send advance reminders before you reach the limit of your agreed terms and don’t be afraid to follow-up emails with phone calls. A polite call to check that the recipient has received your email can go a long way.

- Automate payments where possible. There are plenty of tools these days for getting paid electronically and instantly – whether it’s Bacs transfer or PayPal. You could also use Direct Debit. Talk to your bank about an acceptable Direct Debit Instruction form. There are lots of templates online to help get you started. Once this is set up, all you need do is inform your clients in advance that funds are due to debited.

- Offer discounts for early payment of invoices and apply interest to late payments. You have a legal right to claim interest up to 8 per cent above the Bank of England base rate. But make sure this is set out in your terms before you claim. Discounting invoices can make a huge difference to your cashflow and reduce the amount you spending on chasing invoices.

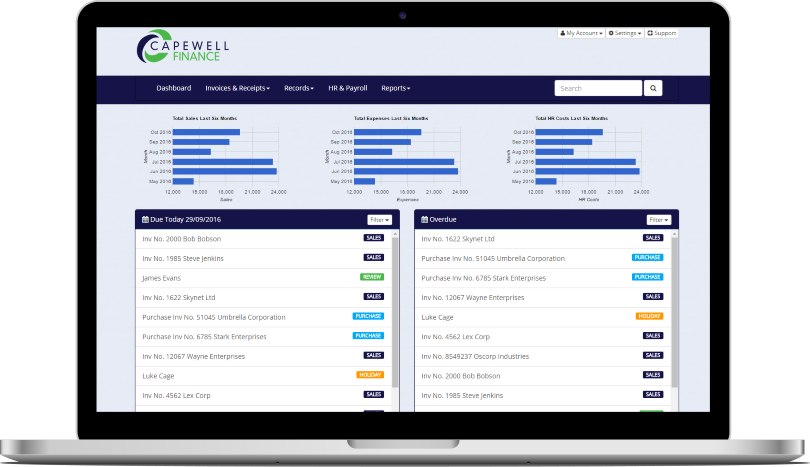

- Use an online bookkeeping tool, like Capewell Finance & HR. The benefits of this are several-fold. Firstly, there is a huge time-saving element, with users able to set up and email client invoices and reminders within the platform. Secondly, the handy bar charts and reports provide an up-to-date snapshot of where your company finances are at, helping you to plan ahead and act accordingly.

- Use good judgement. It’s great winning new business and we all get carried away sometimes, but be careful about that new client who doesn’t scrutinise your rates and is overly eager to use your services. The old saying “if it’s too good to be true…” often applies in business. If you are feeling uncertain about a new client’s ability to pay, ask for a percentage of your initial fees upfront, or get references from other clients to help put your mind at rest.

If you do have any questions, we have a dedicated helpline enabling you to talk to a real person, who will provide all the support you require.

Get in touch. Ask a question.

If you have any questions about the security of your data or would like to chat with a 'human' for some piece of mind then call us on +44 (0)121 794 2277 or email info@capewelldata.com.